A great solution for small employers looking for their first benefits package.

Mental Health Support

Prevent burnout, tackle major life events or learn to deal with stress and anxiety. Employees get up to 10 sessions with a mental health professional.

24/7 GP

Employees and their immediate family can video call a UK-based GP from the comfort of their own home. No doctors’ surgeries or waiting for an appointment.

Second Medical Opinions

If you’re concerned about a diagnosis or the medication you’ve been prescribed, this service provides a case notes review by world-leading specialists

Fitness & Nutrition

Qualified nutritionists will support employees with bespoke fitness programmes, ranging from diet and exercis plans to stopping smoking.

Financial & Legal Helplines

Help with budgeting more effectively, reducing bills, consumer and property disputes.

FOUR FIXED-BENEFIT OPTIONS

Guaranteed Employee Life Insurance, covering pre-existing health conditions

Your first benefits package includes a simple death benefit for family or loved ones if an employee dies before

their State Pensionable Age. It’s pre-priced so you don’t need to provide any employee details before your

policy starts – and employees don’t have to answer any health questions.

The cost is tax-deductible for your business and the benefits are tax-free. All we ask is that you include

everyone who receives PAYE earnings, and that you buy them the same level of cover.

Reasons to buy

1

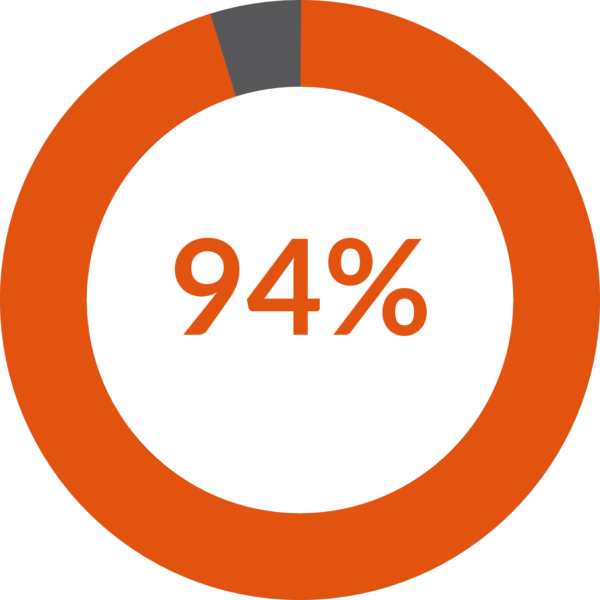

Boost recruitment

say benefits package is an important factor when choosing a job¹

2

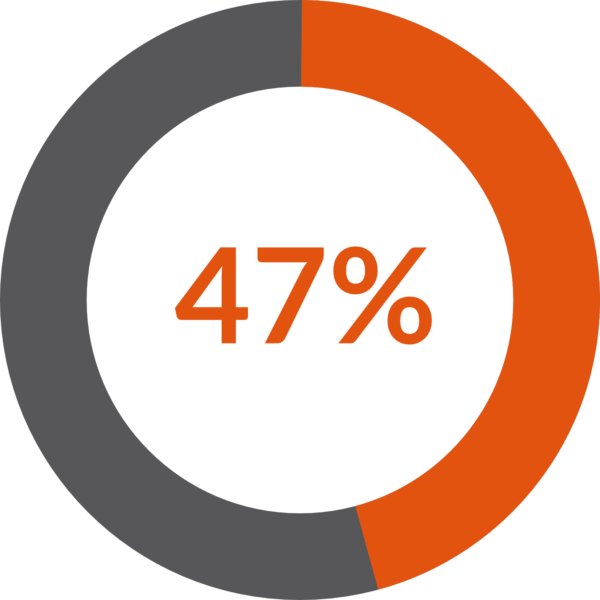

Improve retention

say better employee benefits will improve retention²

3

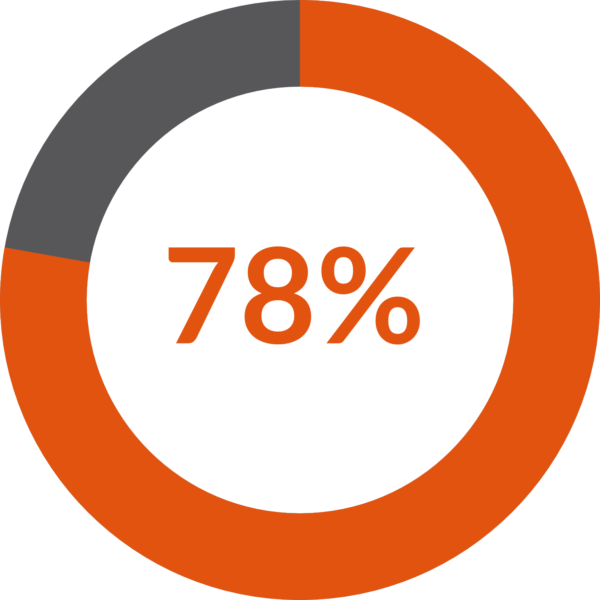

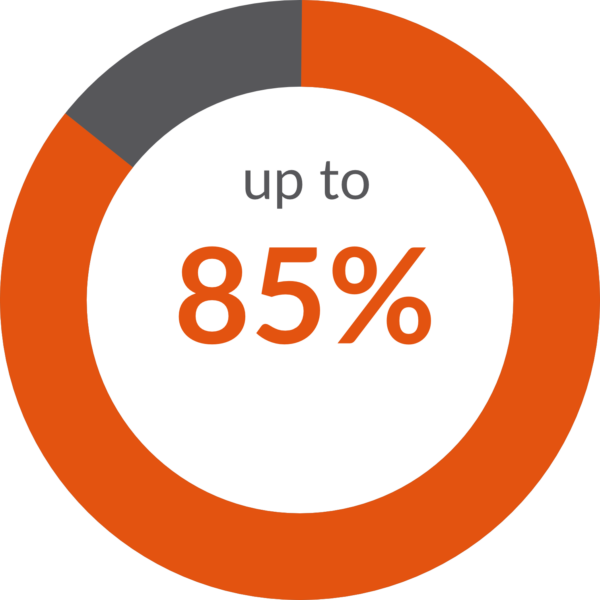

Phone based GP services on the rise

of us would rather use a phone-based GP³

4

Keep your employees fit, healthy and productive

of productivity is lost from poor health4

- https://employeebenefits.co.uk/statistics-show-the-importance-of-employee-benefits/

- https://www.recruitment-international.co.uk/blog/2019/04/94-percent-say-better-employee-benefits-will-improve-retention-research-finds

- https://www.pulsetoday.co.uk/news/technology/patients-prefer-phone-consultations-over-face-to-face-appointments-finds-survey/

- https://www.hrdive.com/news/poor-mental-physical-health-carry-significant-risk-for-productivity-loss/556689

Help with things that matter

Health

GP Consultations

24/7 access to a UK-based GP, via video or phone call, with no usage limits. Employees can even get private prescriptions delivered to their door.

Second Medical Opinions

Get a second opinion on almost any diagnosis, from one of 50,000 leading consultants worldwide.

Stop Smoking

On-going support and tips from a team of specialists to help quit smoking.

Mental Health

Mental Health Support

Up to 10 personalised counselling sessions per issue, for employees and their immediate family.

Burnout Prevention

Guidance to address the symptoms of burnout before it becomes overwhelming.

Life Events Counselling

Personalised sessions to help when suffering after a life event.

Wellbeing and

healthy living

Healthy Diet

Hints and tips on how to improve your diet, from work lunches to inspired mid-week meals.

Get Fit Programme

Access to a custom four or eight week get fit programme, with a structured exercise and diet plan.

Diet Support

Guidance from a professional nutritionist, who will arrange a weekly diet plan, plus top tips when eating out.

Financial and

legal support

Financial

Guidance on a range of issues, from budgeting tips and financial education to making the most out of work benefits.

Legal

Legal experts to help you with a range of issues, from property law to consumer disputes.

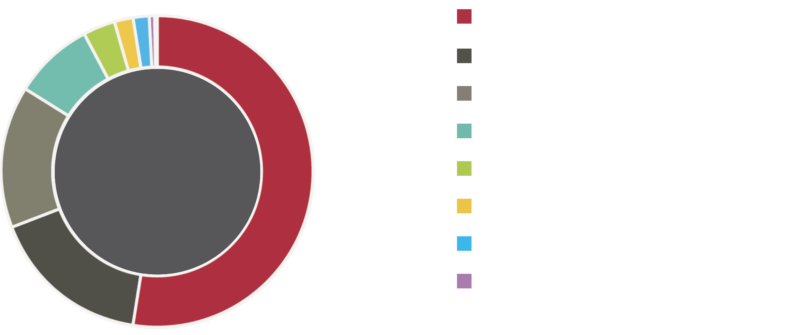

Why do people use the service?

Data taken from Canada Life and Teladoc UK Internal MI, April to December 2020.

A free webinar is available on request, to explain your new benefits when your plan has been set up.

A free webinar is available on request, to explain your new benefits when your plan has been set up.

Four simple life insurance benefit options - From £9 per month

Monthly cost Per employee

Insurance Payout

1

2

3

4

These prices are guaranteed for two years from the start of your policy, and are payable by monthly Direct Debit. All we ask is that you include everyone who receives PAYE earnings, and that you buy them the same level of cover.

This cover pays out tax-free to family or loved ones when an employee passes away.

Value for money

– Fixed costs and benefits

– From as little as £9 per month

Easy and instant set-up

– No medicals

– No cancellation penalties

– GDPR compliant

– No employee details required

until after your policy is set up

Free Trust document

included

– Benefits are tax-free because

we arrange them via a HMRC

approved Policy and Master

Trust, so there’s no individual

HMRC paperwork

AS EASY AS 1, 2, 3

Backed by Canada Life, the UK’s largest Group Life Assurance company

Backed by Canada Life, the UK’s largest Group Life Assurance company

Didn’t find what you’re looking for? Click here for other options